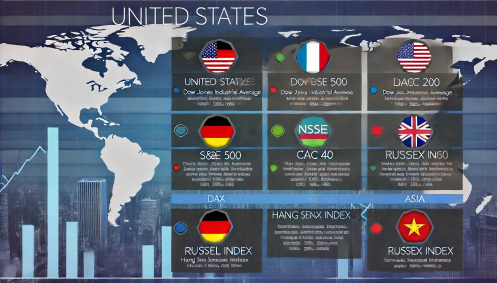

United States Indices

Dow Jones Industrial Average (DJIA): Often referred to simply as “the Dow,” this index tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the Nasdaq. It’s one of the oldest and most frequently cited indices in the world, reflecting the health of the industrial sector and the broader U.S. economy.

Standard & Poor’s 500 (S&P 500): Encompassing 500 of the largest companies listed on U.S. exchanges, the S&P 500 offers a broader perspective of the overall market performance, making it a reliable indicator of economic health.

Nasdaq Composite: This index is notable for its heavy concentration of technology companies, reflecting the performance of the tech sector alongside a mix of other industries. It includes all the stocks listed on the Nasdaq stock exchange.

Russell 2000: Focusing on smaller companies, the Russell 2000 index is a benchmark for the performance of small-cap stocks in the U.S., offering insights into the domestic economic activity beyond the dominant blue-chip companies.

European Indices

DAX (Germany): The Deutscher Aktienindex tracks 40 of the largest companies listed on the Frankfurt Stock Exchange, serving as a prime indicator of German and, by extension, European economic health.

FTSE 100 (United Kingdom): The Financial Times Stock Exchange 100 Index, or “Footsie,” measures the performance of the 100 largest UK companies by market capitalization, listed on the London Stock Exchange.

CAC 40 (France): This index represents the top 40 stocks in the Euronext Paris, providing insight into the French stock market and broader economic trends.

IBEX 35 (Spain): The principal index of the Bolsa de Madrid, it comprises the 35 most liquid Spanish stocks traded in the Madrid Stock Exchange General Index, reflecting the health of Spain’s economy.

Asian Indices

Nikkei 225 (Japan): This index is composed of 225 top-rated companies listed on the Tokyo Stock Exchange, offering a glimpse into the health of the Japanese economy and the Asian market at large.

Hang Seng Index (Hong Kong): It tracks the performance of the largest companies listed on the Hong Kong Stock Exchange, reflecting the economic outlook of Hong Kong and, indirectly, mainland China.

Shanghai Composite Index (China): Including all stocks listed on the Shanghai Stock Exchange, this index provides a comprehensive view of the Chinese stock market and economy.