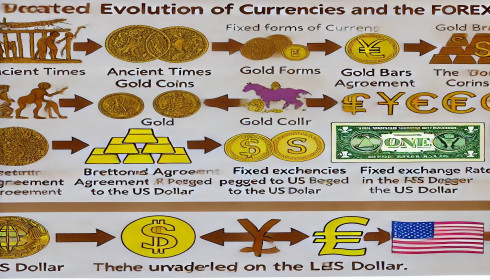

Currencies, often referred to as forex or FX, represent the fundamental units of trade and economic exchange in the global market. The history of modern currency trading can be traced back to the Bretton Woods Agreement of 1944, which established a system of fixed exchange rates where currencies were pegged to the US dollar, which was in turn convertible to gold. This system provided stability and predictability in international trade, but it began to unravel in the late 1960s.

The Bretton Woods system officially ended in 1971 when President Richard Nixon announced the suspension of the dollar’s convertibility into gold. This marked the beginning of the modern era of floating exchange rates and the dominance of fiat currencies—currencies that have no intrinsic value and are not backed by physical commodities like gold or silver. Instead, the value of fiat currencies is derived from the trust and confidence that individuals and governments place in them.

In the earlier days of currency trading, the British pound (GBP) was known as “cable” because the exchange rate between the pound and the US dollar (USD) was transmitted across the Atlantic via a submarine communications cable. This term is still in use today among forex traders, reflecting the deep historical roots of the currency market.

The transition to fiat currencies facilitated a new era of interbank trading, where banks around the world engage in high-volume currency transactions. The forex market is now the largest and most liquid financial market in the world, with an estimated daily trading volume exceeding $6 trillion. Interbank trading forms the backbone of the forex market, where banks trade currencies with each other for various purposes, including speculation, hedging, and arbitrage.

Currency trading in the interbank market is conducted primarily through spot and forward transactions. Spot trading involves the immediate exchange of currencies at the current market rate, known as the spot price. This type of trading is prevalent because it provides instant liquidity and is straightforward. Forward trading, on the other hand, involves contracts to exchange currencies at a future date and a predetermined rate. These contracts are used to hedge against future currency fluctuations and manage risk.

In addition to spot and forward trading, the currency market also offers options. Currency options provide the right, but not the obligation, to exchange currencies at a specified rate on or before a certain date. These instruments are used by traders to hedge against potential adverse movements in exchange rates and to speculate on future price movements.

The forex market is characterized by several major currency pairs, which are the most heavily traded and liquid pairs in the market. These include EUR/USD (euro/US dollar), USD/JPY (US dollar/Japanese yen), GBP/USD (British pound/US dollar), and USD/CHF (US dollar/Swiss franc). Each of these pairs has its own unique characteristics and trading dynamics, influenced by economic indicators, geopolitical events, and market sentiment.

One of the most famous events in currency trading history is when George Soros “broke the Bank of England” in 1992. Soros, through his Quantum Fund, speculated that the British pound was overvalued and would be forced to leave the European Exchange Rate Mechanism (ERM). He placed a massive bet against the pound by short-selling it, and when the UK government was unable to maintain the currency’s value within the ERM, the pound plummeted. Soros’s fund reportedly made a profit of $1 billion from this single trade, demonstrating the profound impact that currency speculation can have on national economies.

The dynamics of currency trading are complex and multifaceted, involving a deep understanding of economic indicators, market psychology, and global events. Successful currency trading requires a combination of technical analysis, which examines historical price patterns and trading volumes, and fundamental analysis, which assesses economic data and geopolitical developments.