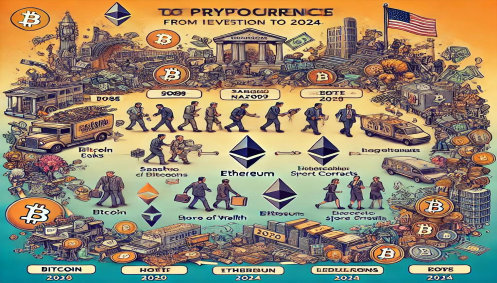

The story of cryptocurrencies isn’t just about digital money; it’s a saga of a financial revolution sparked by the aftermath of the 2008-2009 financial crisis. This period of economic turmoil, characterized by failing banks and financial institutions, eroded trust in traditional financial systems. In the midst of this chaos, an anonymous entity or person under the pseudonym Satoshi Nakamoto released a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This paper proposed a decentralized currency, Bitcoin, which could operate independently of centralized authorities like governments and banks.

The early days of Bitcoin were marked by a community of adopters who were mainly tech enthusiasts and libertarians. These individuals were drawn to Bitcoin’s promise of financial sovereignty and privacy. They were the pioneers in mining and trading the currency, testing and strengthening the system. The novelty of mining cryptocurrency—a process where individuals use computer power to validate transactions and are rewarded with new currency—added to its allure.

As Bitcoin gained attention, its use expanded beyond a niche group of early adopters. It wasn’t long before the underlying technology of Bitcoin, known as blockchain, sparked a new wave of innovation. This led to the creation of Ethereum by Vitalik Buterin, a programmer inspired by Bitcoin but frustrated by its limitations. Launched in 2015, Ethereum introduced the concept of smart contracts, self-executing contracts without the need for intermediaries. This opened up possibilities far beyond simple monetary transactions, from automated loans and insurance to tokenizing real-world assets.

The rise of Ethereum marked the beginning of the “altcoin” era—alternative cryptocurrencies derived from Bitcoin’s technology but designed for various uses and with different underlying algorithms. Today, there are thousands of altcoins, each purporting to offer different features and improvements over Bitcoin, such as faster transaction times, greater privacy, or more efficient energy usage.

However, the journey of cryptocurrencies has not been without its pitfalls. The ecosystem has been plagued by high-profile hacks and scams, shaking investor confidence and prompting calls for regulation. For instance, the infamous Mt. Gox hack in 2014 saw 850,000 bitcoins stolen, highlighting the security vulnerabilities in digital wallets and exchanges.

Despite these challenges, by 2024, cryptocurrencies have carved out a significant niche as a store of wealth. High net-worth individuals and hedge funds, in particular, have embraced cryptocurrencies such as Bitcoin as a form of digital gold to hedge against inflation and currency devaluation. This shift has been bolstered by advancements in security and a growing regulatory framework, which have helped legitimize its use.

Yet, the vision of cryptocurrencies as a medium for daily global transactions remains somewhat elusive. While there are regions and communities around the world that have embraced cryptocurrencies for everyday use, widespread adoption as a daily transactional currency is still in progress. Factors such as volatility, regulatory uncertainties, and technical barriers continue to impact its feasibility for common transactions.

In essence, the cryptocurrency narrative is one of rapid evolution and resilience. From its inception as an alternative to traditional currency in the wake of a financial crisis to its role today as both a speculative investment and a new frontier in financial infrastructure, cryptocurrencies continue to fascinate and challenge the conventional boundaries of finance. Whether or not they will become as ubiquitous as the currencies minted by governments remains to be seen, but their impact on the financial landscape is undeniable.