Bitcoin emerged in 2009, not just as a new digital currency, but as a radical challenge to the conventional financial system. Born from the ashes of the 2008 financial crisis, Bitcoin offered a vision of money free from central control, secured by cryptography, and powered by a decentralized blockchain network. Satoshi Nakamoto, Bitcoin’s mysterious creator, introduced this novel idea at a time when faith in traditional banks was sorely eroded.

At its core, Bitcoin is a peer-to-peer system for online transactions that does not require a trusted central authority. What makes Bitcoin distinct is its underlying technology, the blockchain, which records all transactions chronologically and publicly. This transparency ensures that transactions are virtually immutable once they are added to the blockchain ledger. This prevents fraud and provides a level of security and trustworthiness crucial in the early days of Bitcoin’s adoption.

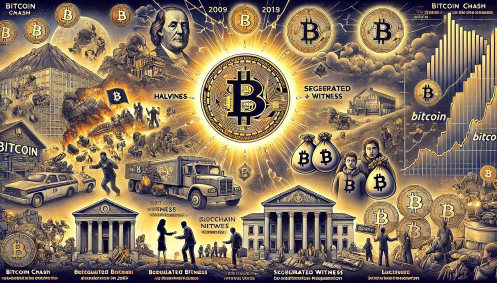

Bitcoin’s journey has been marked by various milestones and technical innovations. Among the most significant are the Bitcoin “halvings,” events that reduce the number of new bitcoins generated per block. These halvings, which occur approximately every four years, slow down the rate at which new bitcoins are created and thus mimic the scarcity and inflation rates of precious resources like gold. Halvings are anticipated events in the cryptocurrency community, often associated with price increases due to the reduced supply of new bitcoins.

However, Bitcoin’s path hasn’t been without challenges. As the network grew, so did the demand for faster transactions and increased scalability. This led to significant debates within the community, particularly around how to manage the size of the blocks within the blockchain. These debates culminated in several forks, or splits in the Bitcoin blockchain. The most notable of these was the creation of Bitcoin Cash in 2017, which increased the block size to allow more transactions to be processed and tried to adhere more closely to what the creators perceived as Nakamoto’s original vision.

Another crucial development in the evolution of Bitcoin was the implementation of Segregated Witness (SegWit) in 2017. This protocol upgrade addressed issues of scalability and transaction malleability by changing the way data was stored in the blockchain. SegWit’s introduction was pivotal as it also paved the way for further innovations like the Lightning Network, which aims to facilitate faster transactions.

Despite these technological advancements, Bitcoin has remained a volatile but attractive asset for investors. Its price has seen dramatic highs and lows, drawing attention from both institutional and casual investors. For some, Bitcoin is a digital form of gold, a potential safe haven against fiat currency inflation. For others, it is a speculative asset that offers significant potential returns.

As of 2024, Bitcoin has not only persisted but has also started to be recognized as a legitimate financial asset by many in the mainstream finance world. While it still faces regulatory scrutiny and widespread skepticism about its practical uses as a daily transactional currency, Bitcoin’s influence on both the technological and financial landscapes is indelible.