Thailand’s Southern Land Bridge project, a $35 billion initiative to connect the Andaman Sea and the Gulf of Thailand via a 90-kilometer infrastructure corridor, is poised to reshape Southeast Asian trade and geopolitics. This analysis explores the project’s potential impacts on regional power dynamics, trade routes, and international relations in the Asia-Pacific region.

Strategic and Economic Impact

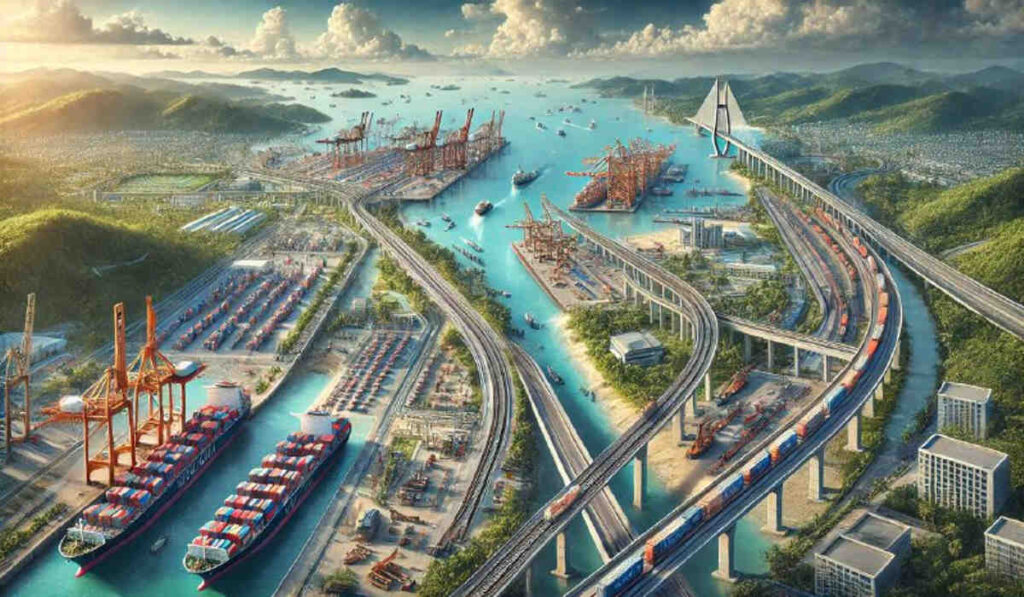

The Southern Land Bridge, linking the ports of Chumphon and Ranong, aims to provide an alternative to the heavily trafficked Malacca Strait. This new route could handle up to 30% of Malacca Strait traffic, positioning Thailand as a significant player in regional maritime logistics and challenging Singapore’s dominance as the primary maritime hub in Southeast Asia. China’s involvement in the project aligns with its Belt and Road Initiative (BRI), seeking to secure strategic maritime routes and reduce reliance on the Malacca Strait. However, this increased Chinese influence may strain Thailand’s relations with other regional powers, particularly the United States, which could see it as a threat to its strategic interests in Southeast Asia. The project’s broader impact on ASEAN solidarity and regional security frameworks is also significant, as it could shift economic benefits and trade routes, exacerbating existing tensions within the bloc.

Economically, the Thai government projects that the Land Bridge could reduce shipping times by 2-5 days compared to the Malacca Strait, potentially saving billions in annual shipping costs. The development is expected to attract $55 billion in investments over the next decade and create up to 280,000 jobs once operational, with projected annual revenues of $3.2 billion from port and rail operations by 2035. However, the project faces competition from Malaysia’s $8.1 billion expansion of Port Klang and Cambodia’s Funan Techo Canal project. The Funan Techo Canal, supported by a Chinese company through a Build, Operate, Transfer (BOT) agreement, aims to connect the Tonle Sap River with the Gulf of Thailand, reducing Cambodia’s reliance on Vietnamese ports and enhancing its strategic autonomy. Sun Chanthol, Deputy Prime Minister and first vice president of the Council for the Development of Cambodia (CDC), clarified that China did not order Cambodia to build the canal. The project, costing around $1.7 billion and employing up to 10,000 workers, mostly Cambodian and Chinese engineers, aims to be completed within four years.

Challenges and Competition

The concurrent development of these major infrastructure projects presents a complex scenario. Securing sufficient funding for all three projects simultaneously is challenging, especially if they are perceived as competing for the same market. Additionally, China’s involvement in multiple projects could lead to strategic balancing by other regional powers like the U.S. and India. Each project must also navigate significant environmental and social challenges that could delay or halt progress. The success of these projects will depend on the demand for improved trade routes and the ability to divert traffic from established routes like the Malacca Strait. Overcapacity could result in underutilization of the new infrastructures, impacting their economic viability.

The Isthmus of Kra poses significant engineering challenges due to its varied terrain, including mountains, forests, and rivers. A canal would require extensive excavation, while a rail or road link would necessitate substantial tunneling and bridging. The estimated costs range from $20 billion to $30 billion for a canal and $10 billion to $15 billion for a rail link. Environmental risks include habitat disruption, water pollution, and changes in local ecosystems. Advanced engineering techniques and sustainable construction practices, such as Tunnel Boring Machines (TBMs) and Building Information Modeling (BIM), are critical for the project’s success.

Financial and Environmental Considerations

The project’s estimated cost runs into billions of dollars, necessitating funding from international investors, development banks, and private sector partnerships. Public-private partnerships (PPPs) are crucial for financing and managing the project. Potential investors include Chinese state-owned enterprises and international financial institutions such as the Asian Development Bank (ADB). A thorough cost-benefit analysis is necessary to ensure economic viability, evaluating potential revenue from tolls, trade facilitation, and increased economic activity against construction, maintenance, and environmental mitigation costs. Effective risk management is essential to handle financial risks such as cost overruns, delays, and economic fluctuations.

The Kra region is home to diverse ecosystems and species. Conservation measures must be integrated into the project design to protect these natural assets, including wildlife corridors, reforestation initiatives, and pollution control mechanisms. The project will affect local communities, particularly those dependent on fishing, agriculture, and tourism. Ensuring fair compensation and providing alternative livelihoods are essential for social acceptability. Sustainable development principles, such as using renewable energy sources and promoting eco-friendly construction practices, can enhance long-term sustainability and reduce environmental footprints.

From China’s perspective, the Kra Land Bridge holds significant strategic and economic value. As part of the BRI, it enhances China’s connectivity with Southeast Asia and reduces reliance on the Malacca Strait. For India, the project offers both opportunities and challenges, potentially improving maritime security but also extending China’s influence in Southeast Asia. Thailand stands to gain significantly, potentially transforming into a major logistics hub, boosting economic growth, and attracting foreign investment. Cambodia and Vietnam could also benefit from improved regional connectivity, enhancing economic integration with ASEAN and global markets. Other ASEAN countries like Malaysia, Singapore, and Indonesia could see significant benefits, though they must adapt to the changing trade dynamics.

Looking ahead, several scenarios are possible: Successful implementation could transform Thailand into a major logistics hub, rivaling Singapore and significantly shifting regional trade patterns. Delays or failures could weaken Thailand’s regional position and reinforce the status quo, benefiting Singapore and Malaysia. Increased geopolitical tensions could force Thailand to carefully balance between major powers.

The Southern Land Bridge project could have significant implications for global supply chains, particularly in light of recent disruptions. The project offers an alternative to the congested Malacca Strait, potentially improving supply chain resilience. This diversification could be crucial in mitigating risks associated with geopolitical tensions or natural disasters affecting a single route. The projected 2- 5 day reduction in shipping times could lead to more efficient inventory management and reduced carrying costs for global companies, particularly those in time-sensitive industries. The new route could prompt multinational corporations to reconfigure their regional distribution centers, potentially shifting some operations from Singapore or Malaysia to Thailand. The potential for more predictable shipping times could support just-in-time manufacturing practices, although this benefit may be offset by the need to adapt to a new logistics paradigm. Given China’s potential involvement in the project, escalating U.S.- China trade tensions could impact the reliability of this route, necessitating careful risk management by global supply chain operators.

The project’s coastal location makes it particularly vulnerable to climate change impacts. Both the Andaman Sea and Gulf of Thailand coasts are susceptible to sea level rise. The project’s design must incorporate long-term projections to ensure its viability over its expected lifespan. Increasing frequency and intensity of tropical storms could disrupt operations and damage infrastructure. Robust engineering and contingency plans are essential. The project could exacerbate existing coastal erosion problems, particularly if mangrove forests are cleared for construction. This could increase vulnerability to storm surges and flooding. The estimated 20,000 hectares affected by the project include sensitive coastal ecosystems. Balancing development with environmental preservation will be crucial for long-term sustainability. The project presents an opportunity to implement cutting-edge climate adaptation technologies, such as flood-resistant infrastructure and green coastal defenses. This could position Thailand as a leader in climate-resilient megaprojects. While potentially reducing shipping distances, the project’s construction and operation will have a significant carbon footprint. Incorporating renewable energy and low-emission technologies could mitigate.

For investors, the project presents both opportunities and risks. The estimated $20 billion in contracts for engineering and construction firms represents significant potential returns. Real estate in the project’s vicinity could see 30-50% value appreciation within five years of completion. The Thai government’s designation of 100 square kilometers around each port as special economic zones, offering tax incentives, further enhances investment appeal. However, these opportunities are counterbalanced by substantial risks. The project’s reliance on Chinese investment, potentially up to 40% of total funding, exposes it to geopolitical tensions. Any escalation in U.S.-China relations could delay or derail the project. Environmental concerns, with the project affecting an estimated 20,000 hectares of coastal areas, present both challenges and opportunities for green technology investments. Currency markets may also see significant impacts. Analysts project a potential 5-8% appreciation of the Thai Baht against the US Dollar over the medium term if the project proceeds as planned, with corresponding effects on other regional currencies.

Thailand’s Southern Land Bridge project stands at the intersection of economic ambition and geopolitical strategy, poised to significantly impact Southeast Asian trade dynamics. Its successful implementation could transform Thailand into a pivotal logistics hub, offering an alternative to the heavily congested Malacca Strait and potentially reshaping regional power balances. However, the project faces substantial hurdles. Securing the necessary financial investments in a competitive market, managing complex environmental and social impacts, and navigating the geopolitical interests of major powers like China and the United States will be critical to its success. The interplay of these factors will determine whether the Southern Land Bridge can deliver on its promise of enhanced regional connectivity and economic growth. As Thailand moves forward with this ambitious project, careful consideration and strategic planning will be essential to balance economic benefits with environmental sustainability and geopolitical stability. The outcome of the Southern Land Bridge initiative will not only influence Thailand’s future but also have broader implications for trade and relations in the Asia-Pacific region. This project deserves close attention from policymakers, investors, and analysts who must weigh its potential benefits against the inherent risks and challenges.